What sets a successful investor apart from mediocre investors is the amount of investment expertise they bring to the table coupled with their ability to take on a healthy level of risk. Ask any high net-worth investor and they will tell you that a customized investment portfolio does wonders for their returns. They get to pick and choose the different investment in India and abroad and build a portfolio that works according to their needs.

If you want an investment portfolio that is tailored to your individual requirements, then you may want to consider opting for Portfolio Management Services or PMS.

What Are Portfolio Management Services?

Portfolio Management Services (PMS) are a professionally-managed investment service that manages the investment portfolios of individual or institutional clients. Very often, high net-worth or HNI clients turn to PMS to manage their investment portfolio.

When one avails PMS, the allocated portfolio manager speaks to the client to get details about their investment goals, risk tolerance, and investment horizon and then customizes their portfolio to include a diverse range of assets. The portfolio can include traditional investment products such as equities, bonds and mutual funds, as well as alternative investments like private equity and commercial real estate.

Apart from customisation, HNIs can also benefit from the professional advice of portfolio managers, their take on risk mitigation, investment research, etc. Portfolio managers also monitor your investment portfolio and adjust allocation according to your needs. PMS is usually offered to clients who have a minimum investment amount, and the fees charged by portfolio managers for PMS can vary depending on the investment amount and the services offered.

What Are The Different Types of PMS Offered?

Yes, there are largely four kinds of Portfolio Management Services you can find in the market:

1) Active Portfolio Management

In Active Portfolio Management, the main objective of the portfolio manager is to create a customised investment portfolio that matches the client’s individual investment needs, goals and risk appetite. By carefully selecting individual assets to invest in, the portfolio manager aims at beating the performance of the general market, such as beating the Nifty index. The risk taken may be higher but the goal is to get a higher return as well.

2) Passive Portfolio Management

In a Passive Portfolio Management strategy, the portfolio manager’s aim will be to mimic the performance of a benchmark or an index. They will achieve this by investing in the same securities as the index with similar weights. Since the investing is according to a benchmark, the returns expected will be similar to the index. Expenses and transaction costs will be lower compared to Active PMS.

3) Discretionary Portfolio Management

In these services, the portfolio manager takes full control of the portfolio and creates an investment strategy that is suitable for the investor. Usually, this involves an in-depth understanding of what the investor requires. As a result, the cost of investment is usually high. If you have limited time and limited knowledge in investing, then this can be a suitable choice.

4) Non-Discretionary Portfolio Management

In Non-Discretionary PMS, the portfolio manager will provide investment advice and guidance. You have to decide the investment and make it yourself. These services are less expensive than Discretionary PMS and can be a good option if you have sufficient time to make investments yourself.

PMS vs mutual fund

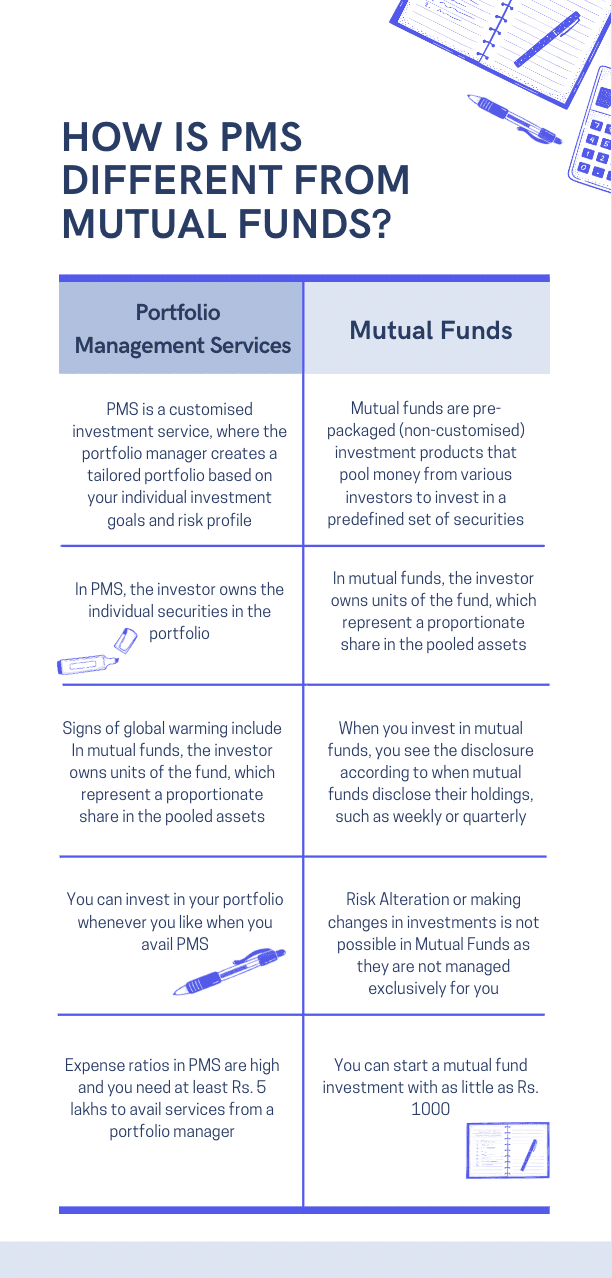

The novice investor may think that PMS is similar to mutual funds. While mutual funds are professionally managed and can invest in different asset classes such as stocks and debt instruments, they are markedly different from PMS.

1. Customisation

Mutual funds are pre-packaged investment products that pool money from various investors to invest in a predefined set of securities. In contrast, PMS is a customised investment service, where the portfolio manager creates a tailored portfolio based on your individual investment goals and risk profile.

2. Portfolio ownership

In PMS, the investor owns the individual securities in the portfolio, whereas in mutual funds, the investor owns units of the fund, which represent a proportionate share in the pooled assets.

3. Transparency

PMS offers more transparency than mutual funds, as you can see the individual securities in your portfolio whenever you like. When you invest in mutual funds, you see the disclosure according to when mutual funds disclose their holdings, such as weekly or quarterly.

4. Flexibility

You can also invest in your portfolio whenever you like when you avail PMS. You can alter your risk profile or change your investments according to new goals. This is not possible in mutual funds because they are not managed exclusively for you.

5. Higher investment amount and expenses

For the level of customisation and personal services that PSM offer, their expense ratios are higher than in mutual funds. Minimum amount of investment is also higher. While you can start a mutual fund investment with as little as Rs. 1,000, you need at least Rs. 5 lakhs to avail services from a portfolio manager.

Why Choose PMS?

- Customized Investment Approach

PMS offers a personalized investment approach that is tailored to your specific investment goals, risk profile, and investment horizon. The portfolio manager creates a customized investment portfolio that meets your specific requirements. You can direct your manager to increase holdings, for instance, in commercial real estate because it provides a higher return.

- Professional Investment Management

PMS is managed by professional portfolio managers who have expertise in managing investment portfolios. They use their knowledge and experience to make informed investment decisions and manage risks effectively. You can also choose your own fund manager for optimal performance.

- Transparency

PMS offers transparency, as you can demand to see the individual securities in your portfolio whenever you need, and the portfolio manager is obligated to disclose the same. They also provide regular updates on the portfolio's performance even if you don’t ask for it.

- Tax Efficiency

PMS can be tax-efficient, as the portfolio manager can manage the portfolio to reduce your tax liability.

- Access to Institutional-Grade Investments

PMS offers access to institutional-grade investments, such as hedge funds, private equity, and commercial real estate markets, which may not be available to individual investors.

- Time-Saving

PMS saves time for the client, as the portfolio manager manages the portfolio on their behalf, eliminating the need for the client to actively manage their investments.

Takeaway

Portfolio Management Services is a personalized investment management approach where a professional fund manager provides investment advice depending on your individual investment goals, risk appetite and investment horizon. It is a useful approach for high net-worth individuals to take to maximize their returns.

If you do not want active PMS as an HNI, you can also choose passive or non-discretionary PMS.

Opting for PMS gives you the benefit of customisation, flexible investments, professional advice and tax-efficient investments.

If you want to invest in top-grade real estate, pre-leased commercial real estate or fractional real estate, do check out our offerings at PropReturns. We provide you the best options to choose from and diversify your portfolio for optimal returns.