The Real Estate Investment market is skyrocketing. This is because the realty market has finally picked up its pace after COVID-19. Moreover, investors are looking at rent-generating commercial realty assets as a lucrative investment option.

But, how do you finance a commercial property purchase?

Many consider a loan as one of the best ways to finance a property purchase. And while it's a pretty standard practice in the residential sector, applying for / getting a loan for a commercial property is comparatively tough. Especially when it comes to understanding the eligibility and nuances.

But don't worry! This blog will take you through the basics and eligibility that will help you get kick started on commercial property loans.

Useful Read: Commercial Property Loan Types

Let's begin!

Commercial Property Loan: Basics

- Meaning:

The amount of money borrowed from a bank to purchase a commercial property - such as retail, hotel, industrial, office, multi-family, etc. - is called a commercial property loan.

- What can you avail commercial property loan for?

1) Based on the construction stage, a commercial property loan may be assigned for ready-to-move or under-construction properties.

2) You may also avail of a commercial loan for extension, construction, or renovation. Alternatively, you may also avail of a combined loan that funds both - buying a plot and the construction.

- How much percentage of the loan you can get for a commercial property purchase?

In India, a home loan funds around 75-90% of the purchase. But, for commercial properties, the number lies at 55% of the total purchase price.

This means that the remaining 45% of the purchase price has to be paid by the buyer using means other than a loan.

- Commercial Loans are 'Secure Loans'

This means that if the loan is not paid, the bank can take over the property and auction it to recover the loan amount.

- What is 'Joint Ownership' in Commercial Property Loan?

In the case of joint ownership (where multiple parties pool money to buy a property), all the owners need to be co-applicants for the loan.

- Loan Tenure

Speaking of loan tenure, a commercial loan can be easily availed for 10-15 years or till one's age of retirement, whichever is earlier.

- How does loan transaction take place?

In the case of commercial property loan disbursement, the bank pays a lump sum amount directly to the seller when a ready-to-move property is transferred to the buyer's name. Whereas, for under-construction properties, a bank pays the loan amount to the seller in stages that move parallel to the advancement in the construction.

- What is the Processing Fees in Commercial Real Estate Loan?

Typically, residential transactions incur processing fees that can amount to as much as Rs 10,000, whereas commercial property loans are subject to processing fees of up to 1.5% of the total loan value. However, certain banks may have a minimum charge of 0.5% for such loans.

- What is the Average Interest Rate for Commercial Property Loan?

The average interest rates for commercial real estate are higher than that of home loans and may range from 2-18% depending on a variety of factors. Such as property type, construction stage, loan type, tenure, borrower's portfolio, etc.

Useful Read: Commercial loan Rate of Interest as per loan type

USeful Read: 22 Commercial loan providers in India and their interest rates .

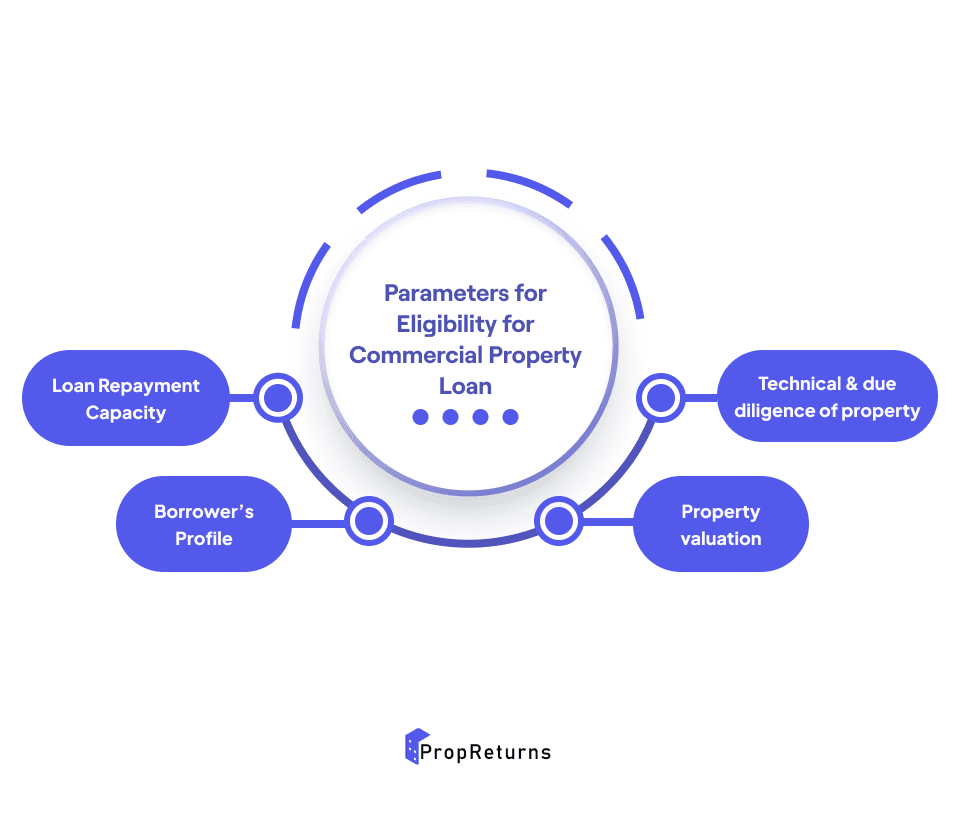

Eligibility for Buy Commercial Property Loan

Banks are weary of loan defaulters and NPAs (non-performing assets). Hence, before sanctioning any loan, they check a variety of factors about the borrower. We have listed them below:

- Loan repayment capacity

Here, the bank checks your annual income and other ongoing loans. They also check your credit score to study your loan repayment pattern. Based on these factors, a bank reaches an approximate calculation of whether or not the loan applicant might be a potential loan defaulter. If the results are negative for potential default, the bank may consider sanctioning the loan amount.

- Technical and legal due diligence of property

With the help of a third party, the bank gets an estimate of the market valuation of the property for which the loan is being asked.

Banks also analyze the legal/financial background of the property to check for any third-party charges, loan/tax dues, liabilities, etc.

The third thing that they check is the builder's profile. In case you apply for an under-construction commercial property loan, the bank checks the builder's track record for delivery and overall profile. Any adverse results in such cases may affect the loan application.

Lastly, they check technical specifications like the building type, its age, its law compliance, etc. Banks have technical analysis teams to verify every aspect before processing the loan application.

- Property value

As we read earlier, a loan can fund up to 55% of the cost of the commercial property.

- Borrower Profile

Banks look at what category the borrower falls under: salaried, self-employed, owns a business, or professional. It's comparatively easier to get a loan for a salaried person, as the bank is assured of a steady flow of income.

They also look at the borrower's occupation and income stability. For this, they check income tax returns, salary slips, and bank statements.

Age is another factor that banks consider when looking at a borrower's profile. A 22-year-old person may get more loan amount as compared to a 65-year-old, as the tenure in the 1st case can be long.

A good credit score (CIBIL score) is important for a good profile.

Assets, liabilities, and dependencies are also checked to get an understanding of the potential for loan default.

If a borrower has a salaried spouse as a co-applicant, the chances of getting the loan increase for them.

Documents Required for Commercial Property Loan

| Documents | Salaried | Self Employed Professional | Self Employed Non-Professional |

|---|---|---|---|

| Application form with photograph and sign | Yes | Yes | Yes |

| Proof of Identity, Residence, and Age | Yes | Yes | Yes |

| Past 6 months' bank statements | Yes | Yes | Yes |

| Past 3 months' salary slips | Yes | No | No |

| Processing Fee Cheque | Yes | Yes | Yes |

| Form 16 / Income Tax Returns | Yes | Yes | Yes |

| Property title documents & Approved Plans | Yes | Yes | Yes |

| Past 3 years' Income Tax Returns with Computation of Income | No | Yes | Yes |

| Past 3 years CA Certified / Audited Balance Sheet & Profit & Loss Account | No | Yes | Yes |

| Education Qualification Certificate | No | Yes | No |

| Proof of Business Existence for 3 years & Business Profile | No | No | Yes |

Commercial Property Loan Tax Benefit

If you take out a business loan to purchase a commercial property, you may be eligible for a standard deduction of 30% of the amount of taxable income you invested in equipment, technology, and building materials used for repairs, and renovations to the property. This deduction can be beneficial in terms of reducing your tax liability.

Commercial Property Loan EMI Calculator

Calculate your property loan EMI with ease using this Commercial property loan EMI Calculator

Tips to remember while applying for Commercial Real Estate Loan

- Compare interest rates at multiple banks and choose the one with the lowest rates

- You may increase your loan eligibility by having a salaried spouse as your co-applicant

- Consider government back loans

- Read contracts carefully

Frequently Asked Questions

1. Can A Salaried Person Buy Commercial Property?

Yes, a salaried person can buy a commercial property. There are no restrictions on buying commercial property based on one's employment status.

However, purchasing a commercial property may require a significant amount of funds, and a salaried person may need to avail of a loan to finance the purchase. The eligibility for a commercial property loan will depend on various factors like the salaried individual's income, credit score, financial history, and the value of the property being purchased. If you want to invest in commercial property, check out our offerings here.

Commercial property can be a good investment opportunity for a salaried individual, as it can provide rental income and appreciation in value over time. There are also several commercial property loan tax benefits that a salaried person can claim to reduce tax expenses.