Embassy REIT is the first REIT to settle in India in 2017. Being listed on the IPO for over 3 years, Embassy REIT's growth is quite high compared to the average industry growth of 7.8% in the same period. Furthermore, in this quarter that ended on June 2022, the company has reported a 12% jump, y-o-y, in revenue operations to Rs.829 cr.

Embassy REIT has remained immune even in the second covid wave, maintaining a 90% occupancy rate throughout the year. With such large dividends and interest distributions, would you consider having Embassy REIT in your portfolio? Let's find out!

A. How did Embassy Group settle Embassy REIT in India?

Embassy Group is a leading real estate development firm that started its operations in 1993. Led by Jitu Virwani, Chairman and managing director of the group, the firm has developed an array of spaces in the commercial, residential, warehouse, hospitality, retail, and industrial sectors. The company's operations are spread across Indian and International markets, including Bangalore, Chennai, Pune, Coimbatore, Serbia, and Malaysia.

This is how Embassy REIT was settled in India-

The Embassy sponsor settled the Embassy REIT on - March 30, 2017, for an initial sum of Rs. 5,00,000 in Bangalore, Karnataka.

The Embassy REIT was registered with SEBI on- August 3, 2017, as a real estate investment trust under REIT Regulations, drafted by SEBI.

SEBI took on record the addition of the Blackstone Sponsor to the sponsors of the Embassy REIT on - August 21, 2018,

The Embassy Sponsor and the Blackstone Sponsor are the sponsors of the Embassy REIT. Embassy REIT EOPMSPL(Embassy Office Parks Management Services Private Limited) has been appointed as the Manager of the Embassy REIT.

The Embassy office park was listed on REIT IPO on - March 20, 2019,

B. Embassy's progress analysis-

Embassy Office Parks REIT, known as the most prominent office REIT in Asia by area, has successfully completed 3 years of listing, with strong business performance. The REIT has delivered over Rs 5,800 crores in distributions to its expanding unitholder base.

According to Jitu Virwani,

Despite the unpredicted global pandemic and the sliding economy, Embassy REIT has consistently delivered over the past 3 years. The REIT has always aimed to give higher long-term returns to its unitholders. The REIT also focuses on delivering growth as the corporates implement back-to-office programs and office leasing gains momentum.

Last 3 years update-

In the 3 years, the firm has -

Leased 6.4 million square feet across 135 deals.

Increased its occupier base to over 200 blue-chip corporations.

Delivered 2.5 Msf of new space, including 1.1 MSF of J.P. Morgan campus.

Begun 4.6 Msf of new development.

Update on FY2021-FY2022

Embassy REIT has also acquired and integrated a 9.2 million square feet marquee asset, Embassy TechVillage, in India's best micro-market in Bangalore.

The company reported its net operating income up by 58% to Rs. 2,491 crores in FY2022 compared to FY2019.

Its operating margin stood at 84%, and it has distributed over 5,800 crores to unitholders. With 15% annualised total returns and grew unitholders base by 10 times to over 40,000 in the last three years.

Embassy's June 2022 progress update-

In contrast to the 5 million square feet leasing guidance for FY23, the Q1(April-June) leasing was 1.8 million sq. ft across 25 deals-one of the highest in a single quarter for the Embassy group in the past 7 years!

The leasing for Q1 includes new leasing of 415,000 sq ft at 31% re-leasing spreads and above market rents, end-of tenure renewals of 80,000 sq ft, mainly by IT occupiers at Pune and Noida, and 550,000 sqft pre-commitment.

Embassy REIT ended the quarter with a stable occupancy of 87% and 1 msf of the new deal pipeline.

Embassy's REIT dividend history

Embassy's extensive office assets-

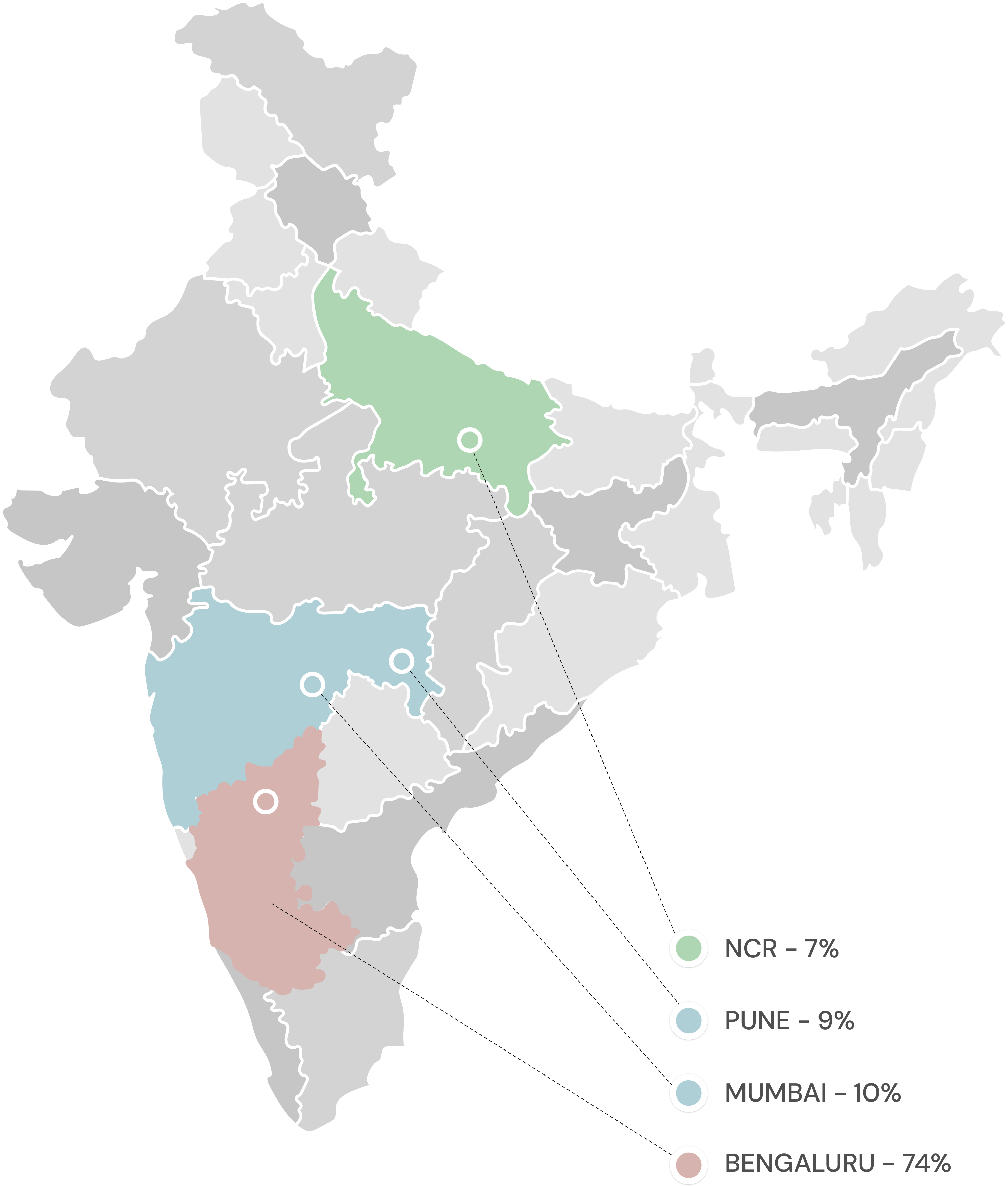

As mentioned earlier, the Embassy office park REITs has its assets in India's top cities, which include Delhi NCR, Pune, Bangalore, and Mumbai.

1) BANGALURU-

- Embassy Manyata Business Park-

A variety of facilities and amenities are available at Embassy Manyata Business Park, including intra-city transportation, outdoor sports zones, rooftop football arenas, a food court with over 1,000 seats, and an amphitheater with 600 seats. The park has a completed area of 11.8 million square feet and offers an integrated business ecosystem to its occupiers. It houses 68 tenants with more than 100,000 park users.

| Site area | Leasable area | Occupancy rate | No. of tenants |

|---|---|---|---|

| 121.76 acres | 14. 8 msf | 87.0% | 44 |

- Embassy Golf Links business park-

Embassy Golf Link business park is one of India's awarded and recognised places. It is strategically located in the hotspot of Bengaluru city. The park adjoins the picturesque KGA Golf course offering panoramic views of the greens. Golflink offers an integrated office ecosystem with 4.5 million square feet of completed area.

| Site area | Leasable area | Occupancy rate | No. of tenants |

|---|---|---|---|

| 65 acres | 3.1 msf | 99% | 25 |

- Hilton hotel at Embassy Golf Links-

Hilton hotel by Embassy is located in the Golf links business park. As this is too situated in the heart of Bengaluru, the hotel connects to the KGA Golf course offering great views of the greens. Its proximity to the airport and Indiranagar recreation hub makes it a center of customer attraction.

| Site area | Market value | Category | No. of keys |

|---|---|---|---|

| 3.59 acres | Rs. 3965 mn | 5 star | 247 |

- Embassy Tech Village

One of Bengaluru's largest office parks is Embassy Tech Village. It is located in North Bengaluru, a prominent growth corridor connecting the airport with the city center, and is easily accessible from the airport. It offers its tenants an integrated business ecosystem with a completed area of 11.8 million square feet. With more than 100,000 park users, it houses 68 tenants.

| Site area | Leasable area | Occupancy rate | No. of tenants |

|---|---|---|---|

| 85.5 acres | 9.2 msf | 99.0% | 45 |

- Embassy One

Located between the central business district and the airport, Embassy One is strategically located on Bellary Road, entering Bengaluru CBD from the international airport. The development includes a luxury Four Seasons Hotel, service residences, elite shopping centers and boutique office space with fast connectivity to the airport. As part of the Embassy One mixed-use development, which includes a luxury hotel and retail space, Embassy One offers small-format office space to corporate occupiers.

| Site area | Leasable area | Occupancy rate | No. of tenants |

|---|---|---|---|

| 3.19 acres | 0.3 msf | 33% | 4 |

- Four Seasons

Located 6km from Embassy Manyata, Four Seasons is the only luxury hotel located in the airport corridor. It is strategically located on a major arterial road between Kempegowda International Airport and the Central Business District (CBD). Lush green spaces surround the building, as well as military grounds adjacent to it. As a landmark destination, Embassy One will raise the bar for living, leisure, and work.

| Market value | Category | Keys |

|---|---|---|

| 7,266 mn | 5 star | 230 |

- Embassy Energy

The Embassy Group's commitment to green and sustainable energy is exemplified by Embassy Energy Private Limited (EEPL), which owns and operates a 100 MW solar power plant in the Bellary district of Karnataka. The Embassy Manyata Business Park, the Embassy Golf Links, and the Embassy Tech Village are all supplied with electricity by Embassy Energy.

| Site area | Capacity | Market value | Annual market value |

|---|---|---|---|

| 460 acres | 100 mw | 9,144 mn | 215 mn |

2) MUMBAI

- Express towers

Mumbai's Express Towers is a landmark Grade A office building owned by institutional investors. In addition, it is close to some of the most affluent neighbourhoods of India. The 1970-built Express Towers offer panoramic views of Marine Drive, the Arabian Sea, the coastal road, and South Mumbai. There is excellent public transportation and Mumbai Metro access to the LEED Silver-certified property.

| Site area | Leaseable area | Occupancy rate | No. of tenants |

|---|---|---|---|

| 1.46 acres | 0.5 msf | 78% | 26 |

- The first international finance center

Located in the Bandra Kurla Complex, the FIFC is Mumbai's Grade- A city center office building. BKC is an area known for financial hubs due to its proximity to the city airports and rail networks. The office space houses some of the greatest financial tenants and commands the highest rents. It is also well-connected to the residential hubs.

| Site area | Leasable area | Occupancy rate | No. of tenants |

|---|---|---|---|

| 1.99 acres | 0.4 msf | 86% | 8 |

- Embassy 247

Embassy 247 is located at a prime location with fine infrastructure. Its proximity to the residential areas makes it a favoured location for corporate occupiers. This is a key factor considering the ease of commute for employees. Embassy 247 is a three-tower development consisting of commercial and retail space in the heart of Vikhroli. This 69-metre-tall structure dwarfs all other developments in this area. It is also equipped with world-class amenities along with a LEED certification. It houses a business centre, ATMs, banks, a gymnasium, food courts, and high-end restaurants.

| Site area | Leasable area | Occupancy rate | No. of tenants |

|---|---|---|---|

| 7.27 acres | 1.25 msf | 84% | 23 |

3) PUNE

- Embassy Quadron

Embassy Quadron is a Grade-A infotech park located in Hinjewadi, Pune. It is one of the most popular office locations in Pune, with a large hub of technology companies. The park connects the transportation links between Mumbai and central Pune. It has an excellent social infrastructure with proximity to the housing sector around. The tech space also has an excellent workforce with many amenities such as restaurants, ATMs, medical facilities, etc.

| Site area | Leasable area | Occupancy rate | No.of tenants |

|---|---|---|---|

| 25.52 acres | 1.9 msf | 50% | 7 tenants |

- Embassy Qubix

Embassy Qubix is a Grade A office park close to the Mumbai-Pune Expressway in Pune, offering tremendous social and lifestyle infrastructure. Embassy Qubix is located in the submarket of West Pune, which offers excellent social and lifestyle infrastructure, various transportation links to Mumbai and Pune Central Business District (CBD), and a large residential catchment that caters to the growing technology workforce.

| Site area | Leasable area | Occupancy rate | No. of tenants |

|---|---|---|---|

| 25.16 acres | 1.5 msf | 90% | 22 |

- Embassy TechZone

Located near the Mumbai-Pune Expressway, Embassy TechZone is a premium business park in its submarket and is spread across a total area of 67.45 acres. This park provides a good social infrastructure with six operational towers and a further 3.3 million square feet of proposed development area.

| Site area | Leasable area | Occupancy rate | No. of tenants |

|---|---|---|---|

| 67.45 acres | 5.5 msf | 84% | 18 |

4) Delhi NCR

- Embassy galaxy

Embassy Galaxy is a 1.4 million square feet Grade A office park located in Noida that is designed based on an open campus-style park. The property is part of an integrated ecosystem with a residential area and universities following a walk-to-work culture. Its submarket has several multinational corporate occupiers, prominent universities, and co-located residential areas with well-planned infrastructure and excellent connectivity.

| Site area | Leasable area | Occupancy rate | No. of tenants |

|---|---|---|---|

| 9.88 acres | 1.4 msf | 89% | 12 teants |

- Embassy Oxygen

Embassy Oxygen is a Grade A office park in Noida, located in close proximity to the Noida-Greater Noida Expressway. The property is among the largest office parks in the city and one of only two special economic zone parks in its submarket, with excellent infrastructure, easy access to talented individuals and brilliant connectivity.

| Site area | Leasable area | Occupancy rate | No. of tenants |

|---|---|---|---|

| 24.83 acres | 3.3 msf | 73.8% | 7 |

What's the scope to invest in Embassy REITs?

Embassy REIT has the highest dividend yield & highest occupancy rate. The company owns & operates 42.8 MSF (million square feet). It has a portfolio of-

- 8 office parks

- 6 hotels (two are under construction)

- a 100 MW solar power plant. It comprises 33.8 MSF completed operating area with an occupancy of 87% as of March 31, 2022.

The growth prospects of REIT depend on the visibility to acquire new assets from the sponsor. According to this, Embassy REIT has-

| Leasable area of | Completed area of | Underconstruction area of | Proposed development of |

|---|---|---|---|

| 42.8 msf | 33.8 msf | 4.6 msf | 4.4 msf |

Besides, Embassy REITs have a sector-level diversification too! Despite its dominance over the IT sector, it is spread across residential, commercial, hospitality, warehouses, and industrial sectors. This results in fewer loss risks in case of unpredictable economic setbacks. In contrast to other REITs, Embassy has a significant hotel exposure (4% of their GAV). The business travel segment of their operations will continue to drag if work-related travel remains muted. In FY22, the company escalated rents by 14% to 7.7 Msf across 89 leases. A 10-15% increase in NOI will result from this.

Embassy REITs have done pretty well since their listing. If you are a savvy investor looking out to invest in REITs to diversify your portfolio, we have numerous real estate investment opportunities on our platform, including REITs. Let's get your portfolio diversified, head to our REITs page now!