India’s real estate sector has gradually evolved into the most opportunistic and flexible investment class. It is extensively contributing to the economy while expanding its arc in residential and commercial segments.

The growing corporate sector increased the need for office spaces and business accommodations. As a result, the development of commercial properties in India also increased parallelly. Due to the lack of public funds in India, these properties constantly need financing channels. Here is where REITs come into the picture.

Real Estate Investment Trusts (REITs) finance, own, and manage income-generating properties and pool the capital of numerous investors, giving them returns in the form of dividends. In short, REITs are modelled like mutual funds.

As the lowest investment amount in REIT is up to Rs. 500, it is indelibly affordable to anyone. Investing in REITs comes with its own set of benefits. But investing with proper analysis and reliable data can help you reap more profits than expected. Therefore, using specific online calculators can come in handy before you make a choice. This blog has covered everything about REITs and how you can invest better using REIT investment calculators.

How do REITs work?

Properties in a REIT portfolio may include apartment complexes, data centers, healthcare facilities, hotels, infrastructure—fiber cables, cell towers, energy pipelines, office buildings, retail centers, self-storage, timberland, and warehouses.

In general, REITs specialize in a specific real estate sector. However, diversified and specialty REITs may hold different types of properties in their portfolios, such as a REIT that consists of both office and retail properties.

The most common module of REITs is to lease commercial or residential spaces to other businesses and then share their rental income among their shareholders (that is you) in the form of dividends.

SEBI introduced REITs in India in 2014. This gave rise to 3 REITs in India- Embassy, Brookfield, and Mindspace REIT.

Perks of investing in REIT

SEBI(Security Exchange Board of India) regulates REITs; hence, they are 100% safe to invest in.

90% of the income generated by REITs is supposed to be distributed to their shareholders.

80% of the REIT companies’ property portfolio should be income-generating and fully constructed.

REITs are highly liquid to invest in; hence, you can sell or buy anytime within seconds!

Let’s look at the returns you can earn by investing in REITs

REITs give you an average annual dividend yield of up to 6%-8%. The IRR (i.e., Internal Rate of Return, the metric used to assess the growth of your investment) retrieved from REIT is about 15%. You get 90% of the income generated by REIT companies.

REITs are listed on stock exchanges, and their returns are often affected by occupancy rates, the quality of tenants, the assets they own, etc. Hence, to achieve the returns given above, you have to keep an eye on the annual returns mentioned on any REIT portfolio before investing.

There are 2 ways of investing in REITs

1) Lumpsum Investment:

The lumpsum investment method is investing a one-time amount that an investor desires in REIT, mutual funds, and similar financial instruments. However, the lumpsum investment is quite tricky for inexperienced investors who don’t know the market and can’t bear the risks. As the amount is huge, they might have to lose a heavy amount of money in case of a sudden loss.

2) SIP investment:

The Systematic Investment Plan (SIP) method is investing a fixed amount of money every month either by an autopay mandate (wherein the amount is retrieved from your account and invested in the particular REIT automatically) or manually investing a set amount every month.

For example, Mr. X invested Rs. 300 in Embassy REIT every month for 12 months. As a result, he signs an autopay mandate, which allows Embassy REIT to withdraw and invest the funds automatically through his bank account.

In essence, Mr. X opted for SIP investment. This method of investing is less risky as you invest in smaller amounts.

If you invest in REITs via SIPs, you are likely to be curious about the amount you might receive at the given rate of return after an expected time.

Hence, the SIP calculator, which you can also call a REIT investment calculator, comes to your help!

How does a REIT investment calculator work?

The REIT investment calculator, also called a SIP calculator, helps you calculate the precise amount you will achieve on your Systematic Investment Plan. To be precise, you can use a SIP calculator to calculate your REIT investments, as these calculators are designed to calculate the returns on investments like mutual funds, REITs, and stocks.

Say, for instance, you have decided to invest in a REIT.

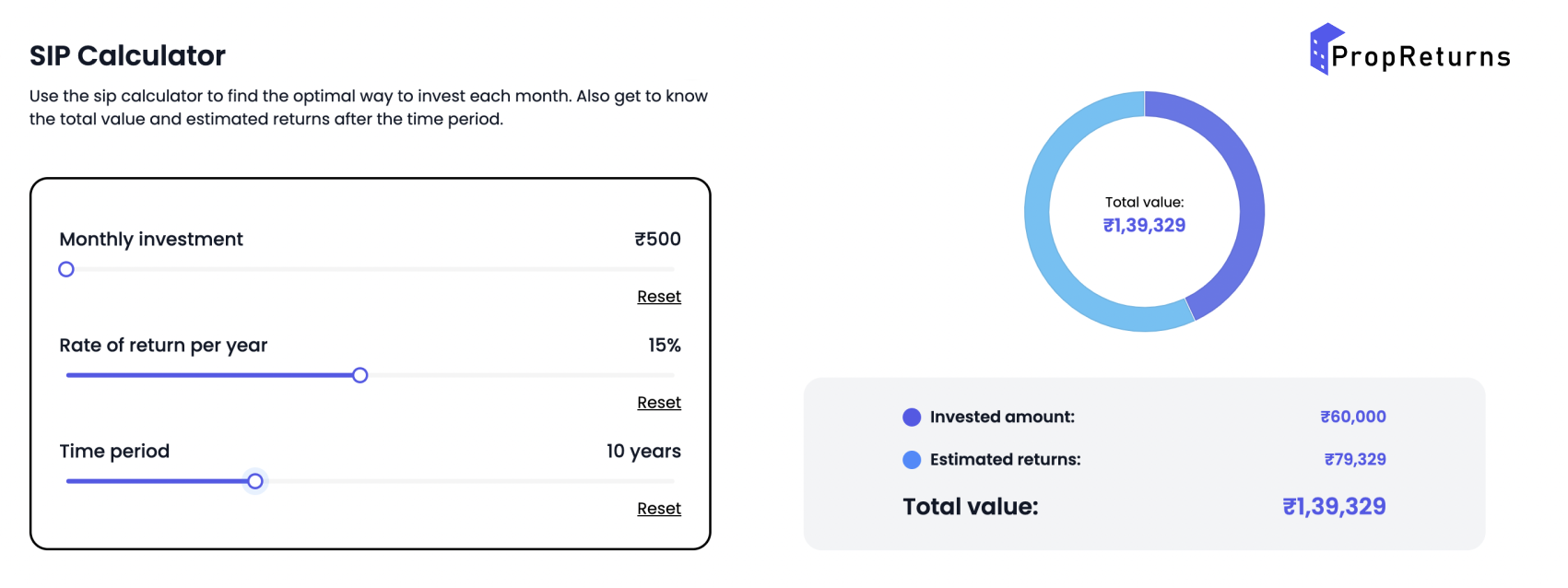

For a period of- 10 years

Monthly investment amount of- Rs. 500

At an annual rate of return of- 15%.

Your total investment amount equals Rs. 60,000, and the estimated profit you will gain at this rate of return is worth Rs. ₹79,329. So, the total value of your investment after 10 years amounts to Rs. 1,39,329.

However, manually calculating larger transactions like these can be time-consuming and confusing. So, the SIP calculator, which can be used as a REIT investment calculator, might help at such times!

It’s that simple! Particularly in India, with its unpredictable economic conditions, a SIP or REIT calculator is extremely valuable. The REIT calculator provides dependable metrics and helps you choose and invest effectively in REITs.

REIT calculators perform well, but we must also take proactive measures. Before investing in any REIT, we must consider the following factors:

Few measures to consider before investing in REITs

1) Portfolio quality and diversification:

An ideal REIT should have a well-diversified portfolio of assets and shouldn’t be limited to a single asset type. To exemplify, a REIT which has a portfolio of hospitality and office assets is more profitable than a REIT which just has a hospitality asset type in its portfolio. If the hospitality sector crashes due to a sudden economic crisis, your investment might be exposed to an unavoidable risk.

2) Net Operating Income (NOI):

NOI determines the revenue and profitability of an invested real estate property after subtracting necessary operating expenses. A higher NOI indicates the good performance of the underlying portfolio and REIT. Generally, NOI depends on the factors like occupancy rates, completion of construction of properties belonging to the portfolio, and rent escalations.

3) Occupancy rates:

Occupancy rate is the ratio of rented or used space by the tenants to the total amount of vacant/available space. A REIT’s occupancy rate decides the expected rental income and, ultimately, the returns you will receive.

In essence, inspecting an investment class manually, as well as making use of technological equipment like calculators, give a valuable contribution to appropriate financial decisions. There are many other real estate calculators that can help you make informed decisions about your real estate investments, just as REIT calculators assist you in determining the return on your REIT investments.

Check out our tools page for such amazing real estate calculators that determine ROI, EMI, SIP, stamp duty charges and much more!