To date, most commercial real estate investors in India continue to make heuristic, or instinct-based decisions rather than informed ones. Why? Perhaps, many are unaware of the variety of available datasets, lack the analytical capabilities to generate insights, and/or are resistant to change. Some may be unsure where to start; others may not know which new skills and capabilities should be added to begin the journey. Here are some of the key barriers:

Lack of awareness about new datasets and analytical techniques.

Traditionally, sourcing accurate property and market-related data has been a challenging task. As such, data gathering, analysis, and reporting is at surface level and requires substantial human effort, which often results in information silos and leaves limited time to analyze information on a more granular level. Investors could spend as much as 80 per cent of their time on gathering or manipulating data to make it ready for analysis.

Limited analytical capabilities.

Investors have limited capabilities when it comes to sourcing, aggregating, and analyzing huge datasets from multiple sources. They need appropriate talent, tools, and technology to effectively leverage data analytics to make investment decisions and comply with more rigorous reporting and risk management requirements.

Limitations of a heuristic mindset. The industry has long thrived on relationships, which is how many investors have traditionally gained access to unique information. However, with increased availability and transparency of data, access to information may not be a competitive advantage anymore.

There will likely be more blind spots as institutional investors seek innovative approaches to diversify their portfolios. For instance, some newer business models, such as short-term rentals for co-sharing spaces, have different dynamics of performance and returns. For investors and managers evaluating these new business models, relying on intuition may not be enough. Use of data analytics would be key to reducing subjectivity.

Power of non-traditional data

Being slow to identify subtle trends means leaving money on the table. Conversely, being a first mover on a compelling (and perhaps inconspicuous) opportunity translates into significant advantage.

Conventional analytical methods and data sources make it challenging to draw clear hypotheses and build robust business cases. By the time an investor can collect, compile, and process the data needed to distill action, the best opportunities are gone.

At the same time, new and unconventional data sources are becoming increasingly relevant. Locality surveys, mobile phone signal patterns, and social media reviews of local restaurants can help identify “hyperlocal” patterns—granular trends at the city block level rather than at the city level. Macroeconomic and demographic indicators, such as an area’s crime rate or median age, also inform long-term market forecasts.

Impact of a data driven approach

A successful data-driven approach can yield powerful insights. During our analysis, we forecasted the three-year rent per square foot for a locality in Mumbai. These machine-learning models predicted rents with an accuracy rate that exceeded 90 percent.

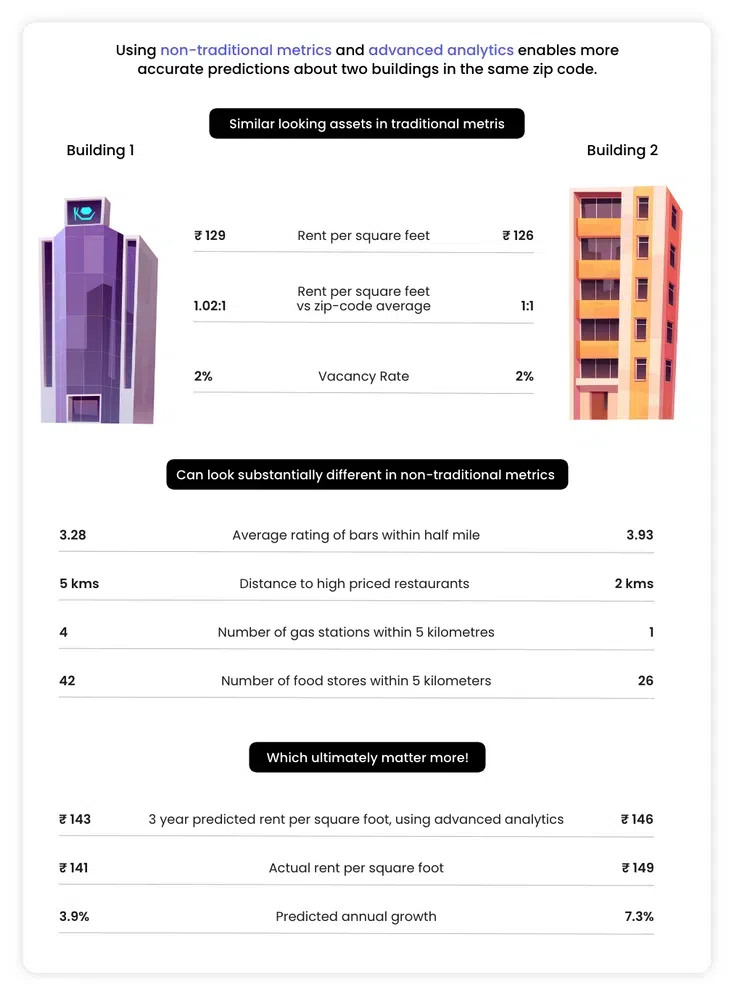

In addition, the exercise illustrated the power of using non-traditional data. Perhaps unsurprisingly, variables related to traditional data sources—for instance, vacancy rates—correlated with future values. But variables related to non-traditional data, such as proximity to highly rated restaurants or changes in the number of nearby apparel stores, explained 60 percent of the changes in rent.

In accounting for these non-traditional variables, buildings located in the same zip code can have widely disparate outcomes in terms of rental performance. Two buildings that are seemingly identical when evaluated by traditional metrics can ultimately experience very different growth trajectories. It is easy to imagine how this disparity at the individual building level, when applied across a series of investments, can drive dramatic results at the portfolio level.

Art of possible

Many real estate investors have long made decisions based on a combination of intuition and traditional, retrospective data. Today, a host of new variables make it possible to paint more vivid pictures of a location’s future risks and opportunities, and with unprecedented granularity.

These solutions evolve at a rapid clip—progress in artificial intelligence is frequently exponential rather than linear—and investors must consider them as realistic supplements to their current underwriting, portfolio review, and research processes. The Indian Real Estate market is being increasingly shaped by such valuable analysis and insights. If investors fail to act now, they run the risk of adapting too late.