If you are a property owner set out to rent your space, the first thing that might cross your mind is, “how much can this property earn for me?”.

Since you have invested significant capital in order to make your asset work for you, this is all that matters. This metric is expressed as a percentage and represents the annual rental income generated proportional to the property's value.

Why Does Rental Yield Matter?

You might be wondering, Why is calculating rental yield such a big deal anyway?.

Well, to put it simply, rental yield serves as an indicator of a property's performance in terms of generating income. By calculating the rental yield, investors can gauge the potential return on their investment. It is a good way to determine the financial viability of a property and what properties need to stay on the portfolio and which ones need to be liquidated.

Where do we come in?

PropReturns’ Rental Yield Calculator is a tool designed to simplify and consolidate your investment and returns data in order to manage your portfolio. It is specifically relevant for the Indian market. There are some key aspects to keep in mind while calculating rental yield so read along to learn more.

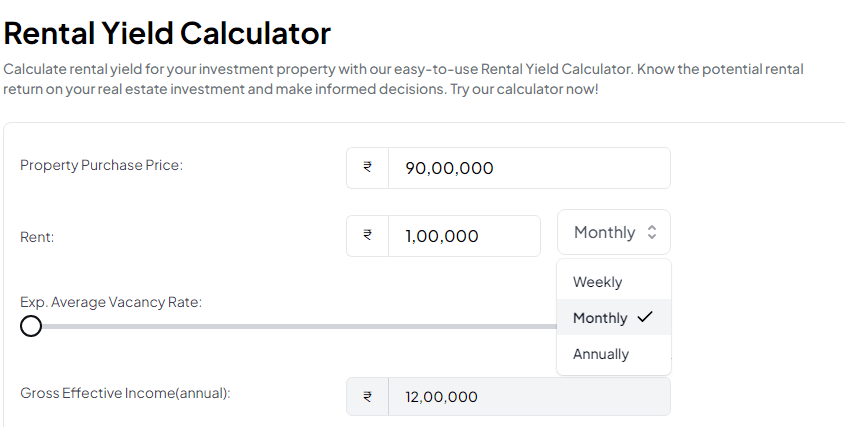

How to Calculate Rental Yield Using the Rental Yield Calculator?

There are two ways to calculate rental yield- Gross Rental Yield and Net Rental Yield.

-Gross Rental Yield: The annual rental income is the total sum of the monthly rental income throughout the year, and by dividing the annual rental income earned by the original purchase value of the property and then taking a percentage of the same, we can derive the gross rental yield of your asset.

Here is the formula to calculate the Gross Rental Yield of your property:

Let’s say that the purchase value of an office space is Rs 90,00,000 and the property is leased out at the rate of Rs. 1,00,000 per month.

Annual Rental Income = 1,00,000 x 12 = Rs. 12,00,000

And so the gross rental yield would be (12,00,000/90,00,000) x 100 = 13.3%

Keep in mind that Gross Rental Yield is only an estimate of the potential rental income and does not take into account any taxes, property maintenance, force majeure situations or any other expenses that may come up while the property is occupied.

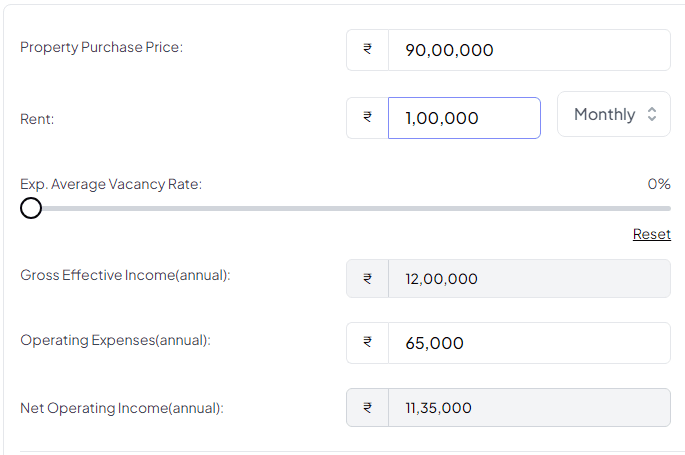

-Net Rental Yield: Net rental yield takes into account any and all overhead charges that may be incurred during the occupation of the property. These expenses include and and all taxes levied, maintenance charges or non occupancy losses.

These expenses are deducted from the annual rental income while calculating the net rental yield.

For example, if the total annual expenses including taxes are Rs. 65,000,

Net Rental Yield = [(12,00,000-65,000)/90,00,000)] x 100 = 12.6%

Net Rental Yield delivers a more accurate representation of estimated rental income from a property and is a more practical and efficient way of consolidating inventory on an investment portfolio.

A typically good commercial rental yield in India should hover around 8-11%. However, this can vary depending on the location of the property, the type of property, market trends, among other factors. Currently, Mumbai, Bangalore and Pune have the highest commercial rental yield.

Payback Period

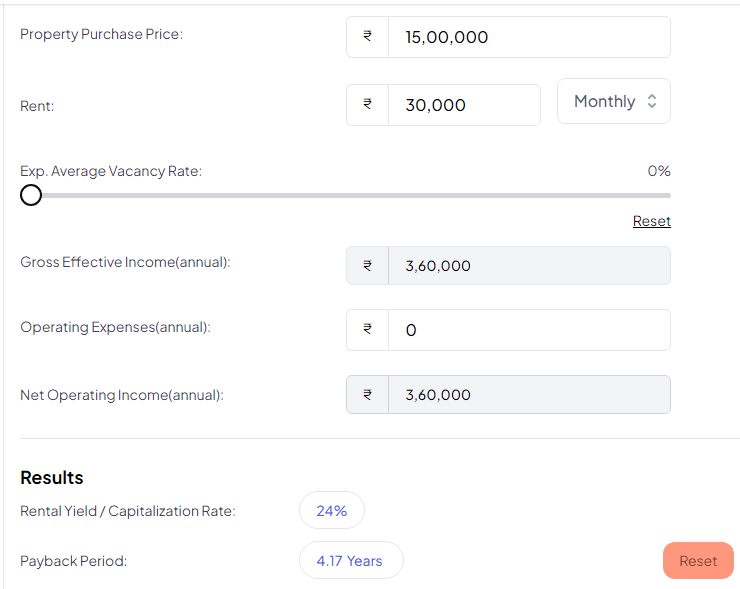

The Payback Period in rental yield refers to the time it takes for an investment in rental property to recoup its initial cost through rental income. Let’s break it down.

Say you bought your dream property for Rs. 10,00,000, do the necessary maintenance and renovations costing Rs. 5,00,000 and immediately lease it out to desiring tenants and charge a rent of Rs. 30,000 per month. In this case, we need to figure out how long it will take in order to recover your initial investment of Rs. 15,00,000 through rental income and eventually turn a profit. This time for recovery of your initial investment is known as Payback Period.

The Payback Period of your real estate investment can be calculated as follows:

Payback Period = Initial investment/annual rental yield In this example, 15,00,000/(30,000 x 12) = 4.17 years.

So basically, with an initial investment of Rs. 15,00,000 and an annual rental yield of Rs. 3,60,000, it will take around 4 years to recover your investment in complete and turn a profit.

Non Occupancy

At some point, it is a possibility if not an inevitability that your property might sit vacant because of circumstances that may not be under your control. This may lead to fluctuations in cash flow and unpredictable returns on your investment. Such a situation must be accounted for and landlords must factor in the chance of how long the property may sit vacant for any given circumstance. Generally, rental yield is zero in such cases and on top of that, sometimes you have to bear the expense of property maintenance, which in turn is often the reason for the non occupancy. Confused? Don’t be.

In order to avoid loss of rental yield due to non occupancy, follow these three key steps:

- Know your market: Let’s say that the office space that you have is catered to a very specific clientele, for example a music recording studio. If your last tenant chose not to renew their lease, it’s time to figure out what exactly are your competitors offering in your line of business that you aren’t. Upping the stakes by offering unique amenities and trying to surpass the competition is the way to go in order to attract and retain tenants.

Tailor your offerings: Commercial real estate is not like buying a hat. One size does not fit all. This applies to both landlords and tenants alike. Amenities are desirable to tenants and landlords prefer favourable rental agreements. The key is finding a common ground that works out for both parties. For example, a corporate office with a break room and a 10 year lock-in rental agreement is favourable for both the tenant’s and the landlord’s financial stability.

Enhance your property value: Simply put, you can leverage the value of your property and earn a consistent rental yield by being diligent with the maintenance and upkeep of your property. A tenant is attracted to a shiny and chic place and is much likely to lock-in for a longer period if all their needs are met in terms of amenities. Updating newer amenities adds to the net rental yield generated.

And there you have it, The Rental Yield Calculator. It is the most important tool in your drawer if you are planning to step into the world of property investment.

Armed with this PropReturns’ Rental Yield Calculator, you can confidently sift through current and potential investments, separate the winners from the losers, plan contingencies for any circumstances and make informed decisions about avenues that need improvement or leveraging.

So, go ahead, crunch those numbers, and watch as your investment dreams turn into cold, hard returns.