If you are a non-resident Indian (NRI) with a property in India that you rent out to a tenant, you ought to know about tax on rental income. Understanding how to calculate tax on rental income for NRIs is crucial to ensure compliance with the Indian tax laws. NRIs must be aware of the applicable rates, exemptions, and procedures to accurately calculate and remit TDS on rent to the Indian government.

Tax Deducted at Source (TDS) is a tax collection mechanism in India that requires the payer to deduct a percentage of tax from the payment made to the payee. This tax is then remitted to the government on behalf of the payee.

In the case of Non-Resident Indians (NRIs) who receive rent from a property in India, TDS is applicable on the rent paid to the NRI.

Can an NRI Receive Rent in India?

Yes, an NRI can receive rent in India.

The rent can be received using a bank account in India or abroad. An NRI needs to ensure that the rental income earned in India is reported in their tax returns and taxes are paid on it accordingly. The amount of tax is calculated based on the TDS on rent paid to NRI under section 195.

Is there Tax on Rental Income for NRIs?

Rental income earned by Non-Resident Indians (NRIs) from property in India is taxable. Here, the NRI needs to file an income tax return in India to report their rental income and pay taxes accordingly. It's important to note that NRIs can claim deductions for expenses incurred in generating rental income, such as property taxes, repairs, and maintenance costs.

However, NRIs may be eligible for tax exemption.

To claim exemptions on tax on rental income, NRIs can do it under the following two circumstances:

1) If your total income including rent is less than the taxable limit of Rs. 2,50,000 per annum, you can obtain and Certificate of Exemption and claim TDS rebate if it is deducted.

2) If you reside in a country that has a Double Tax Avoidance Agreement, wherein you pay taxes on the rent received in India in another country, then you don’t have to file it again in India. India has this agreement with over 90 countries such as the USA, UK, Canada, Australia, among others.

Is TDS Deducted from the Rent Payable to NRIs?

TDS on rental income for NRIs earned in India is applicable under Section 195 of the Income Tax Act, 1961. The TDS rate is 30% of the gross rental income unless the NRI qualifies for a lower rate under the relevant Double Taxation Avoidance Agreement (DTAA) between India and their country of residence.

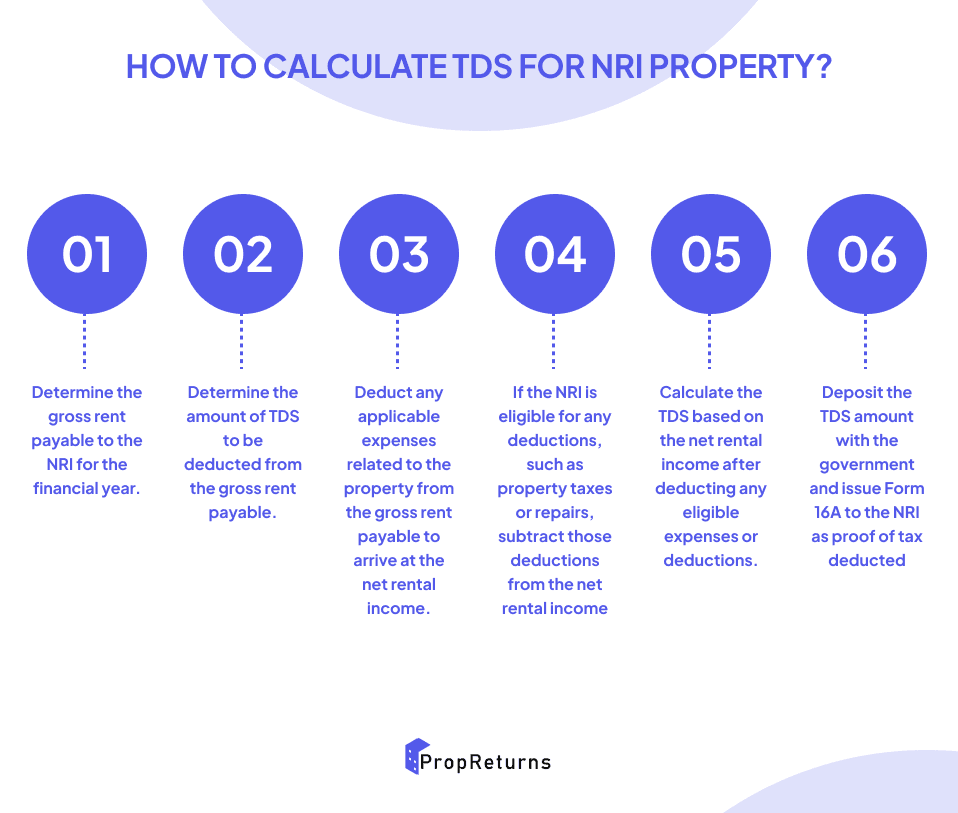

How To Calculate TDS For NRI Property?

The TDS on rent paid to an NRI is calculated as follows:

1) Determine the gross rent payable to the NRI for the financial year.

2) Determine the amount of TDS to be deducted from the gross rent payable. The rate of TDS is 30% of the gross rental income unless the NRI qualifies for a lower rate under the relevant Double Taxation Avoidance Agreement (DTAA) between India and their country of residence.

3) Deduct any applicable expenses related to the property from the gross rent payable to arrive at the net rental income.

4) If the NRI is eligible for any deductions, such as property taxes or repairs, subtract those deductions from the net rental income.

5) Calculate the TDS based on the net rental income after deducting any eligible expenses or deductions.

6) Deposit the TDS amount with the government and issue Form 16A to the NRI as proof of tax deducted.

It's important to note that the NRI can claim a refund of any excess TDS deducted at the time of filing their tax return in India.

What is Form 27Q and 27A for TDS on Rent?

Form 27Q is a TDS return form that the tenant must file for deducting TDS on rent paid to NRIs. This form contains details of TDS deducted, deposited, and other relevant details of the NRI payee. Form 27Q is needed to be filed quarterly.

Form 27A is the summary of Form 27Q. It contains details of the TDS deducted and deposited for all the NRI payees in a particular quarter. Form 27Q is the detailed form that contains the details of TDS deducted and deposited for a particular NRI payee.

How do I Submit a 27Q Form?

Form 27Q is a TDS statement that needs to be submitted by the person deducting TDS on rent paid to an NRI. Here are the steps to submit Form 27Q:

1) Visit the TIN-NSDL website at https://www.tin-nsdl.com. 2) Click on the "TDS" tab and select "Online Forms" from the dropdown menu. 3) Click on "Form 27Q" and select the relevant quarter and financial year for which the TDS statement is being filed. 4) Fill in the required details in the form, such as the name and PAN of the NRI, the amount of rent paid, the TDS deducted, and the Challan details. 5) Verify the details you have entered and then click on "Submit." 6) After successful submission, a Provisional Receipt Number (PRN) will be generated. This can be used to track the status of the TDS statement. 7) Download Form 27A and submit it along with the physical copy of Form 27Q to the nearest TIN-FC (Tax Information Network Facilitation Centre) or TIN-NSDL branch.

It's important to note that the due date for filing Form 27Q is the 31st of July, October, January, and May for the respective quarters. Late filing can attract penalties and interest.

What is the Difference Between Form 26Q and 27Q?

Form 26Q is the TDS return form that needs to be filed for TDS deducted on payments other than salaries, whereas Form 27Q is the TDS return form that needs to be filed for TDS deducted on payments made to NRIs.

How to File TDS Return for Rent to NRI?

The TDS return for rent paid to NRI needs to be filed using Form 27Q. The form needs to be filled with the required details of the NRI payee, TDS deducted, and other relevant details. The form needs to be submitted along with the TDS payment within the due date.

Conclusion

Understanding how to calculate TDS on rent for NRIs is essential for ensuring compliance with Indian tax laws and avoiding any potential legal or financial liabilities. NRIs should be vigilant, follow the prescribed procedures, and seek professional assistance to accurately determine and remit TDS on rent, thereby fulfilling their tax obligations in India.